Why Is Infonomics Important?

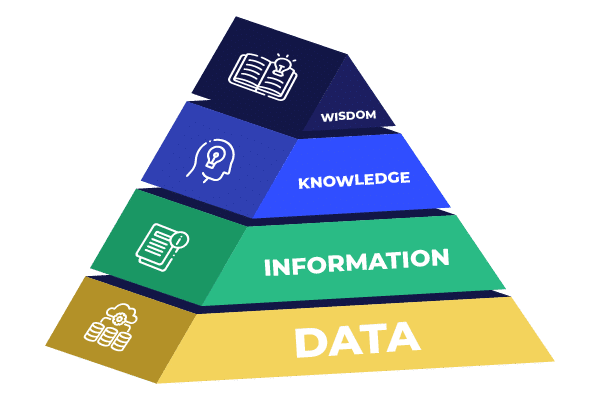

Information is everywhere. These days, data is so prolific and voluminous that we can sometimes forget how valuable it can be. Terabytes of user data, operational logs, GPS coordinates, and other information are stored away in servers each day. What is this information worth? And could it be harnessed to help businesses make more money?

What is Infonomics?

The Definition of Infonomics

Infonomics is an emerging discipline of valuating and accounting for information as an actual enterprise asset. Douglas B. Laney first coined the term in the 1990s. Today, Laney is a distinguished analyst and vice president at Gartner, Inc. and the best-selling author of “Infonomics”.

“Infonomics is the emerging discipline of managing and accounting for information with the same or similar rigor and formality as other traditional assets (e.g., financial, physical, intangible, human capital).

Infonomics posits that information itself meets all the criteria of formal company assets, and, although not yet recognized by generally accepted accounting practices, increasingly, it is incumbent on organizations to behave as if it were to optimize information’s ability to generate business value.”

Simply put, infonomics is information economics. It requires organizations to formally recognize and accept data or information as a veritable business asset. By ascribing value to information, organizations can begin to see value in its production, analysis, and consumption.

The concept of infonomics enables organizations to build info-centric architecture and strategies that focus on the management and governance of data assets. This structure then allows them to quantify and create business value from the data currency that they possess.

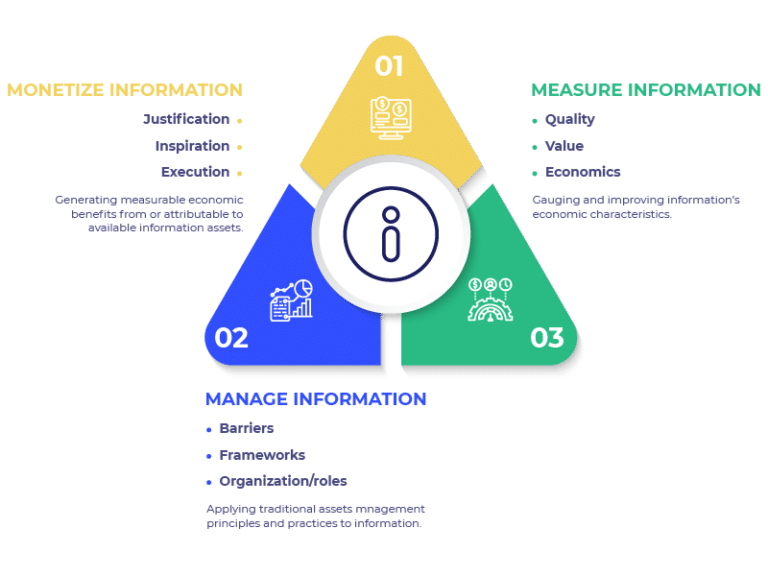

The Three Pillars of Infonomics

As mentioned, infonomics is the theory and discipline of attaching economic value to information. Organizations can apply asset and economic management principles to the information that they gather, own, and distribute. Under the infonomics framework, businesses should monetize, manage, and measure information as an asset.

Monetize

Most people have come to assume that information should be free of charge and readily available. While this may be true to a certain degree, it is easy to see how information has become a precious commodity in our modern, connected society. Information can enable a business to change from flying blind to making targeted and prescribed decisions.

Information can do more than just sell. It can help businesses to streamline operational processes, enhance product or service quality, preempt the needs of the market, and improve business relationships. As a matter of fact, the closer you look at it, the more justifications and inspirations there are for the monetization of information.

You do not have to be in the information business to execute the monetization of information and it does not need to mean directly selling information for cash. Businesses can indirectly monetize information by using data to lower costs, reduce risks, or improve productivity. And much of this data can come from external sources as well.

Manage

Knowledge is power, and losing sight of data use is akin to throwing away money. Many organizations give out information freely to their partners or disregard information that could have many applications. By adopting an infonomics approach, businesses can set up proper systems and user hierarchy structures to enhance data management.

Privacy, compliance, and security requirements are becoming ever more crucial. If businesses want to monetize their information, they need to have a robust framework in place to record and review data access across all data stores. Even if data is meant for internal applications, managers and chief data officers should have a clear view of data access and change actions.

Establishing a working hierarchy for information access is likewise essential. Certain barriers should be set up to prevent sensitive data from being accessed by unauthorized personnel. An agile and secure DataSecOps solution can coordinate information, manage user controls, and deliver real-time data within a well-governed system.

Measure

How do you measure the value of information? In 1975, tangible assets made up 83 percent of the economy. In 2015, it was the other way round—intangible assets accounted for 84 percent of the economy. This was put into practice when Microsoft paid $26 billion for LinkedIn despite the latter holding only $3.2 billion in cash and marketable securities.

Before we can put a value on information, we need to be able to measure it. With information being largely intangible, this process often begins with more questions than answers:

- What was the cost of obtaining or preparing this data?

- How accurate is this data?

- How common or rare is this data?

- How often will this data be accessed and by whom?

- Is it useful as is, or does it need further refinement?

- Is it relevant now, or will it be relevant in the future?

There are a multitude of questions that you could ask about the data assets in your organization. Ultimately, you need to determine the quality of the data, the economics surrounding its acquisition and maintenance, as well as its past, current, and potential applications. Only then will you be able to come up with an approximate value for your information.

What Are the Advantages of Infonomics?

Unchangeable

Compared to traditional assets, information is a much more versatile asset that is laden with untapped potential. We speak of finite and renewable resources, but information is more than that—it is non-depletable. You can use information as many times as you want and it will remain completely unchanged as it is consumed.

Infinite Usage

This unique characteristic means that, unlike a traditional asset that often depreciates with usage, the value of information stays the same. Data assets can be replicated and simultaneously distributed to multiple users yet still retain their value. In fact, they can even appreciate as they are further processed, analyzed, and applied.

Free From Scrutiny

Data assets are beyond traditional limitations in other interesting ways as well. In the eyes of the accounting profession and the IRS, information currently holds no value on balance sheets. Therefore, data assets owned by a company are not considered capital assets at all, allowing businesses to keep information about their data assets to themselves.

Immediate Transactions

Storage and transportation costs are virtually zero for digital transactions. With a click of the mouse, data assets can be transferred instantly to clients anywhere in the world. Businesses benefit from an indelible trail of data, and buyers enjoy efficiency and convenience. Infonomics is a way for agile businesses to disrupt the conventional business sphere.

Summary

Assigning value to something as intangible and subjective as information is difficult. Regardless, forward-facing businesses who want to be part of the evolving digital ecosystem are taking infonomics seriously. By measuring, managing, and monetizing their data assets, organizations can generate exponential value from information that would otherwise simply take up server space.

Cloud Data Security with Satori

Satori, The DataSecOps platform, gives companies the ability to enforce security policies from a single location, across all databases, data warehouses and data lakes. Such security policies can be data masking, data localization, row-level security and more.

Learn more: